Why do we like Datadog Inc?

Reason 1. The growth of the cloud industry

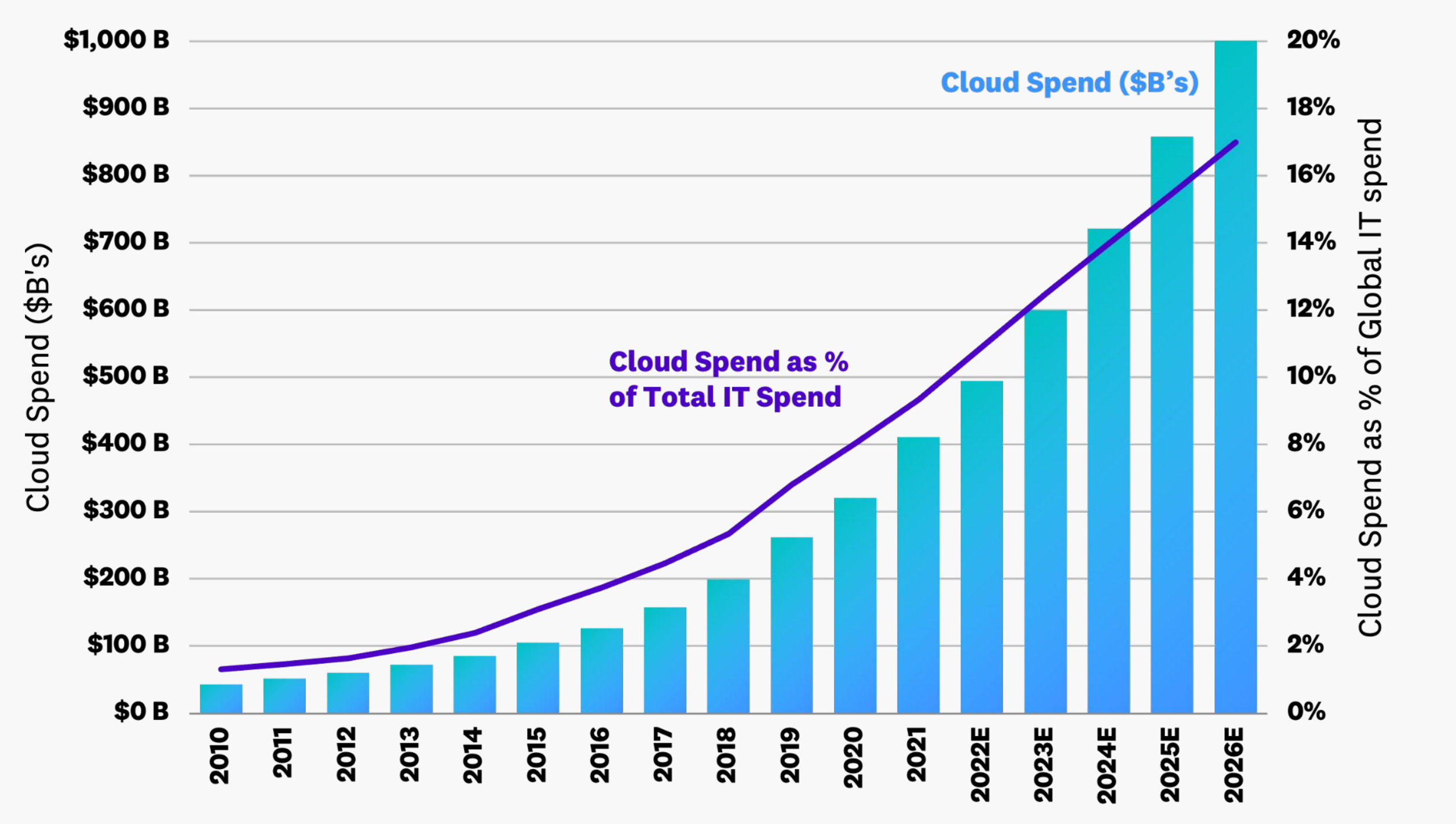

In addition to increased demand for its products due to the general digitalisation of potential customers, Datadog may benefit from business migration to the cloud and an increase in the number of users adopting next-generation DevOps. Gartner estimates that cloud spending as a proportion of total IT spending will increase from ~10% at the end of 2022 to ~17% in 2026.

Source: Investor Presentation

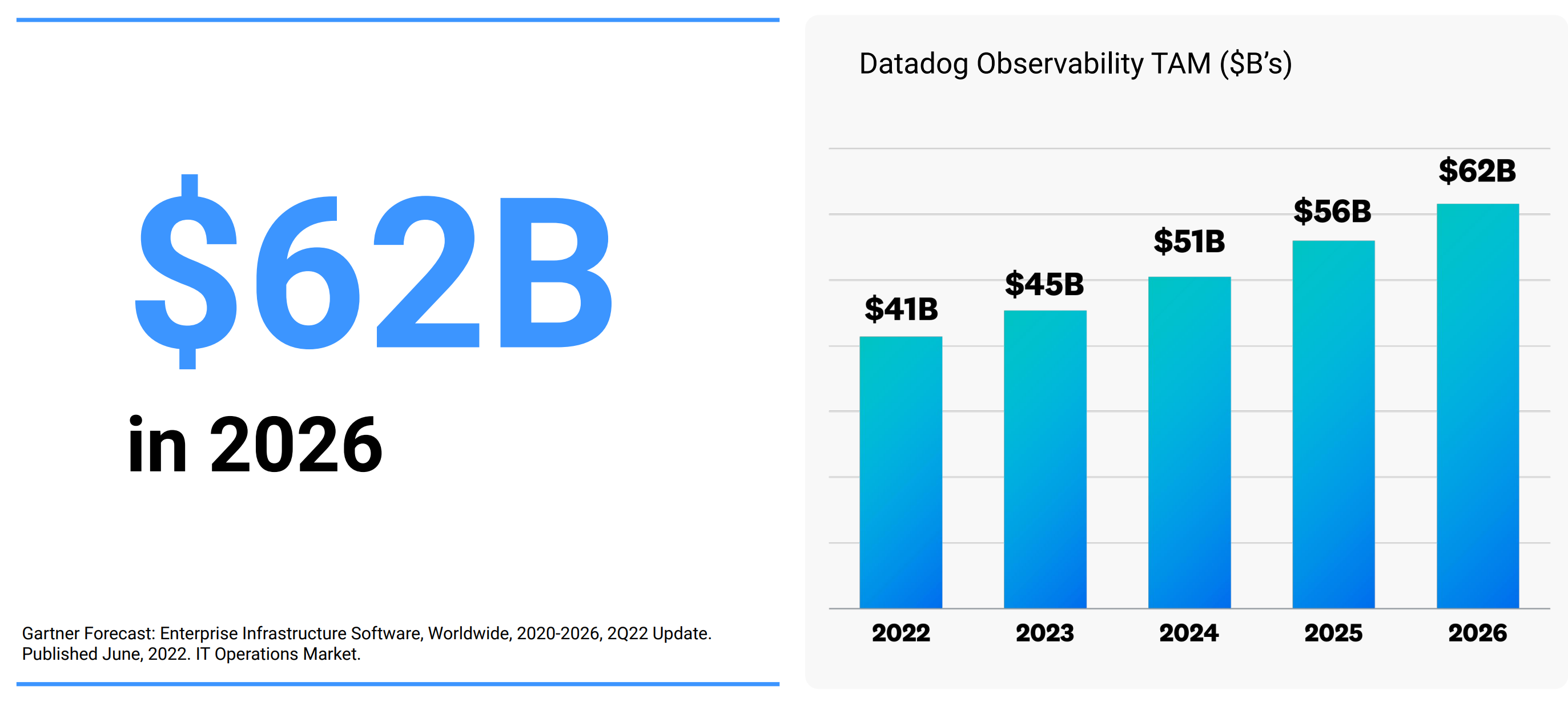

Datadog, which cites Gartner research, predicts the total target market for its key Datadog Observability product will increase from $41 billion to $62 billion over the 2022-2026 horizon.

Source: Investor Presentation

This increase is a good opportunity for Datadog to expand its market share, which should have a positive effect on both the company's financial results and stock price.

Reason 2. New acquisitions and products, entering new markets

On 3 November, Datadog announced the takeover of Cloudcraft, a visualisation service for cloud and systems architects that enables the creation of real-time diagrams of cloud infrastructures. Such a toolkit is highly relevant as users move to the cloud, as it allows them to intelligently model their infrastructure and further reduce the need to update documentation by automatically updating the diagram.

On 19 October, the company unveiled some good news:

- Datsadog has achieved PCI (Payment Card Industry) compliance for its Log Management and Application Performance Management products. Achieving these standards will enable the company to work with more organisations involved with credit, debit and other card data. This means we can expect Datadog's customer base and financial results to expand.

- The launch of Cloud Security Management, which integrates the functionality of several applications into a single platform, enabling the company to respond more quickly to new threats.

- Datadog Continuous Testing is a product designed to help create, manage and run end-to-end tests for web applications. In a rapidly changing macroeconomic environment, businesses often need to adapt quickly and speeding up the testing process is just what you need.

- The launch of Cloud Cost Management is a solution for monitoring an organisation's cloud costs. In the context of customer migration to cloud spaces, the solution will, in our view, be popular, as in the initial stages the task of monitoring resources and analysing the rationality of their use is quite time-consuming.

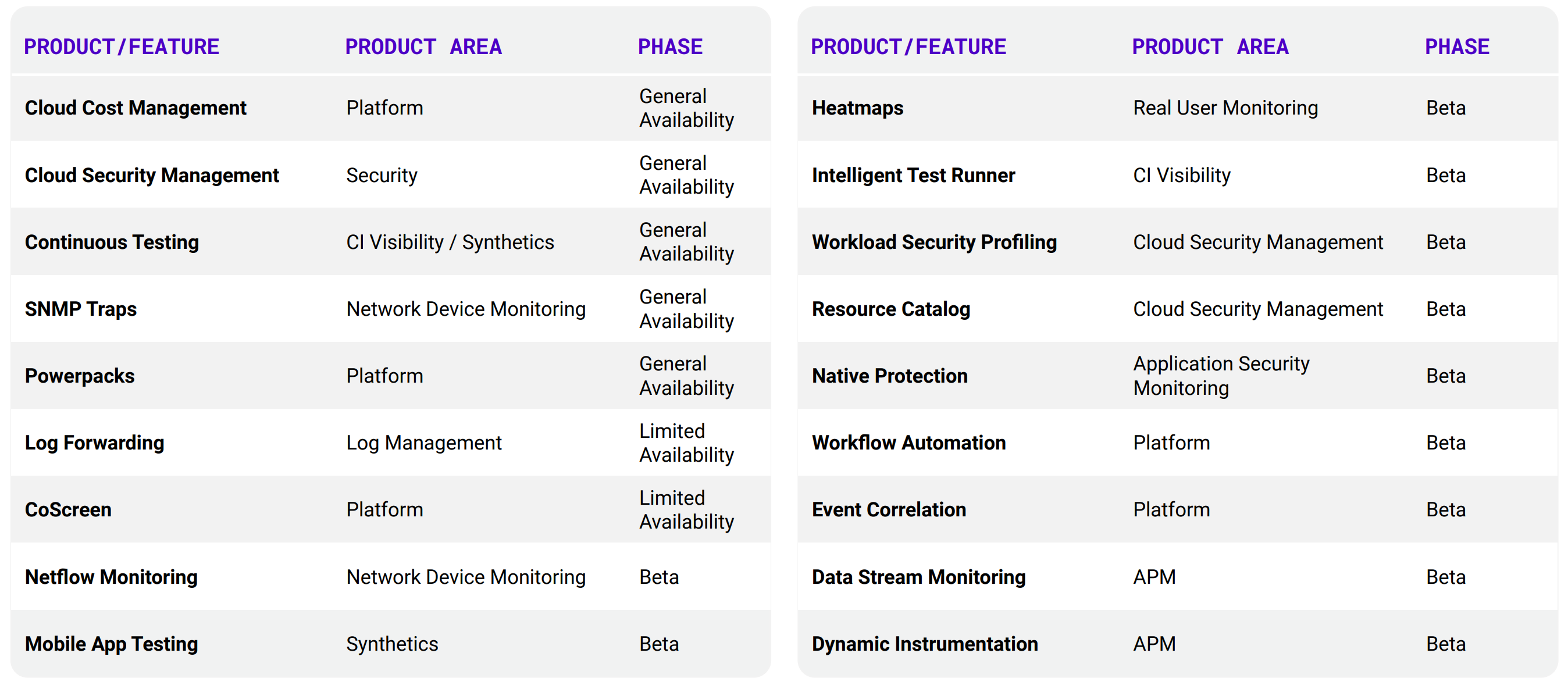

Separately, after the launches described above, Datadog still has 11 more products in beta test (illustration below). We expect them to contribute to improved financial results after the full release.

Source: Dash 2022 Investor Presentation

Reason 3. Investing in research and improving the customer experience

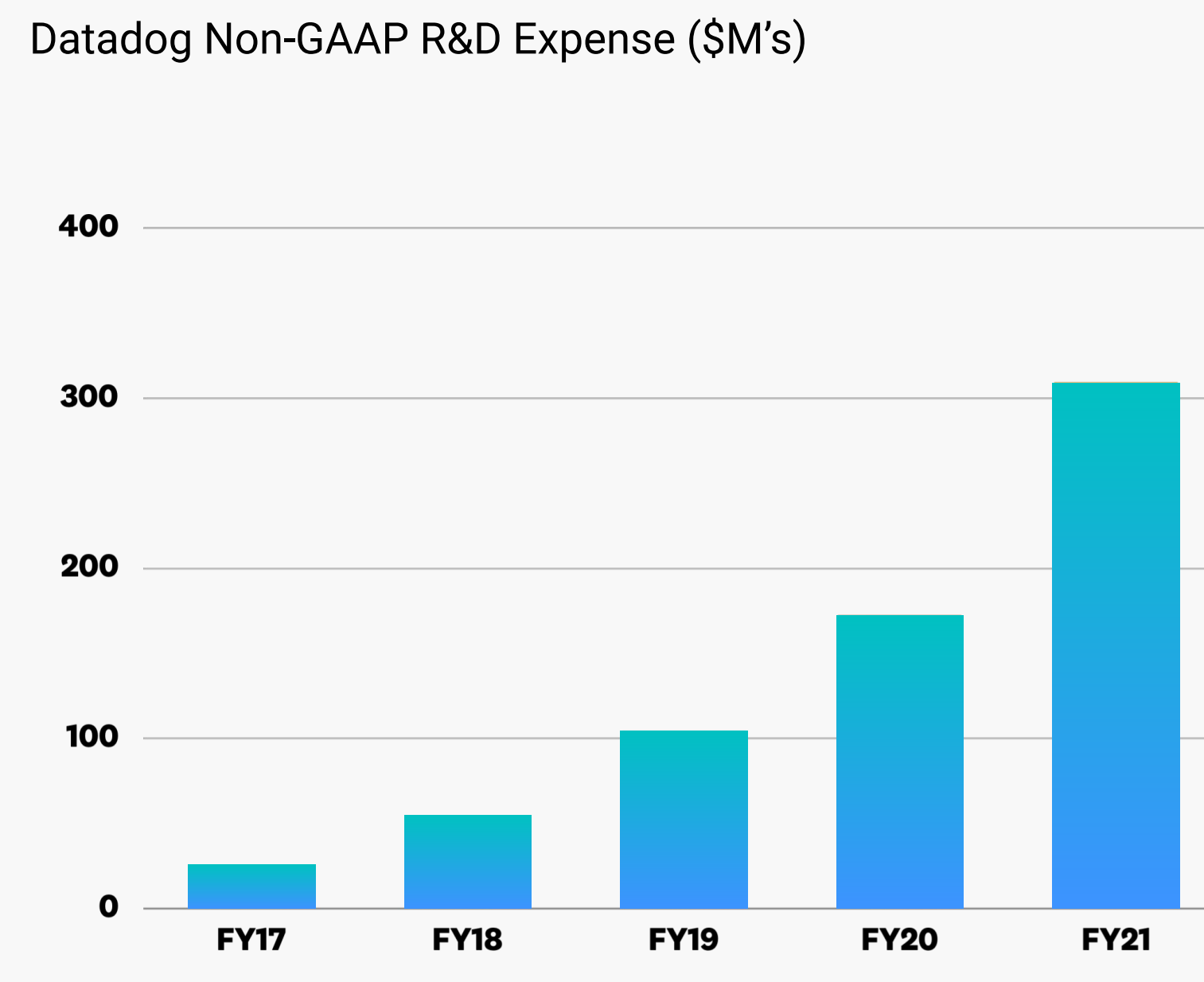

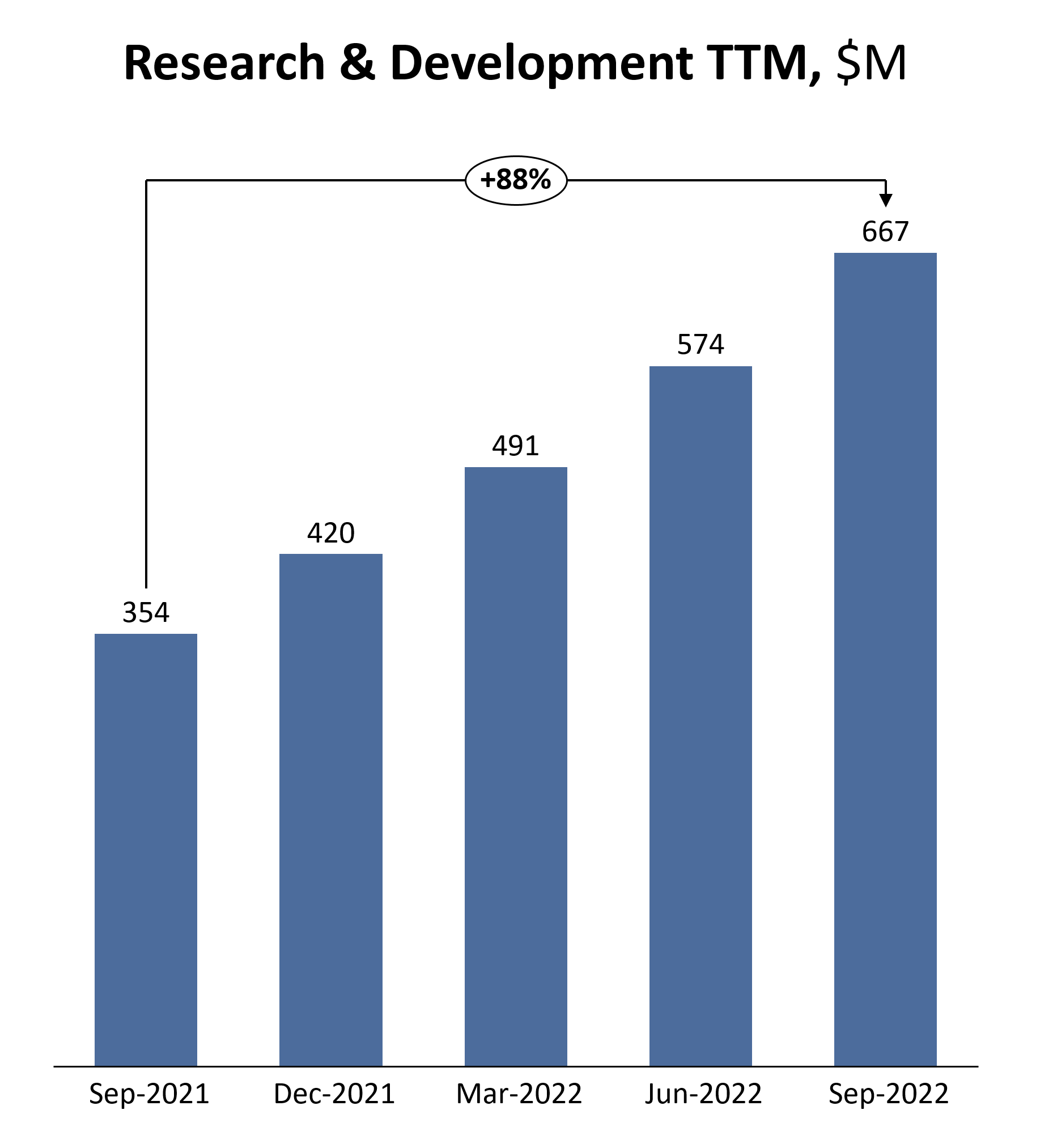

Datadog is focusing on investment in research — its volume has been growing for the past five years (first graph below), and 2022 is no exception.

Source: Dash 2022 Investor Presentation

Data source: Refinitiv

Greater investment in research increases the company's chances of creating an innovative product that can help expand market share.

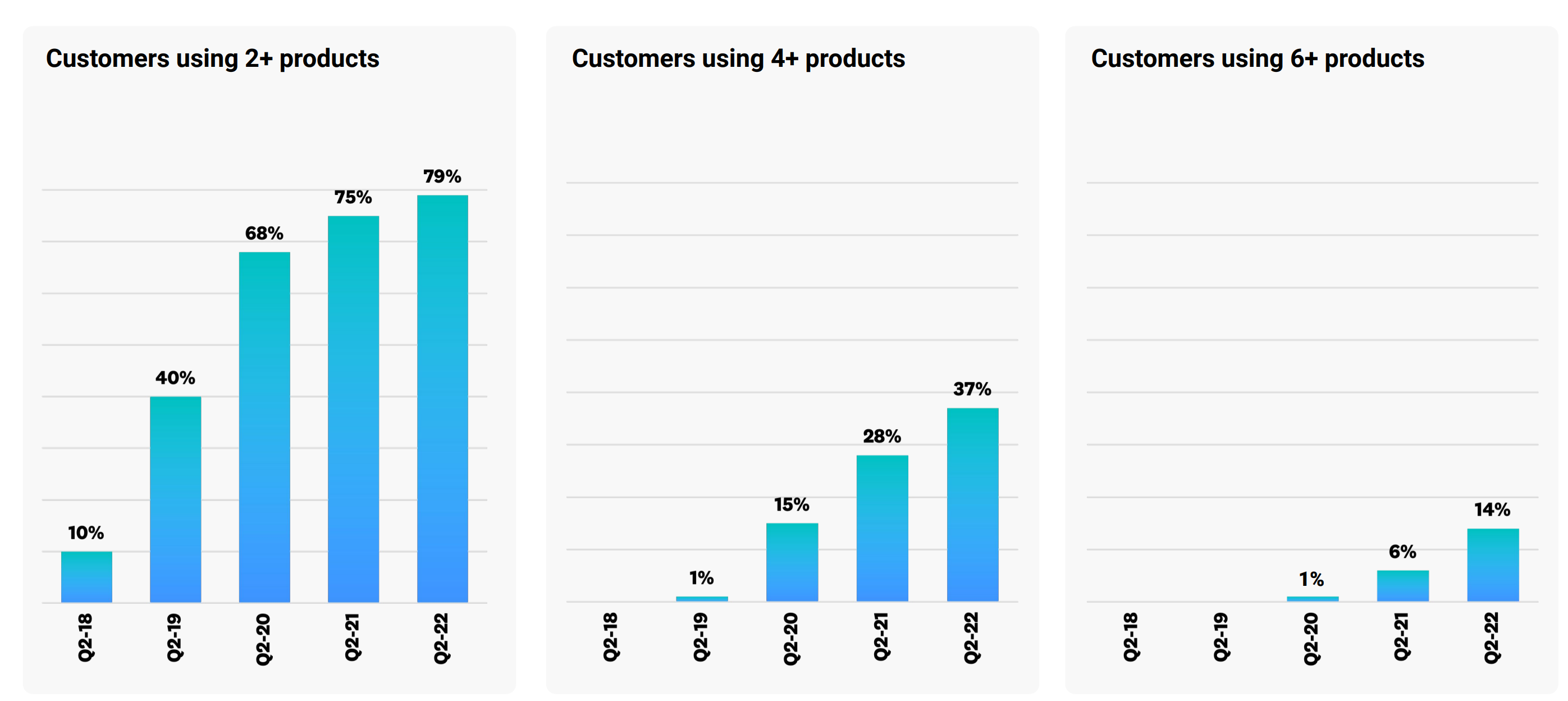

In addition to this, the company's efficient customer service is also helping to grow revenues: the proportion of customers using more than two, four and six products simultaneously has been growing steadily since 2018.

Source: Dash 2022 Investor Presentation

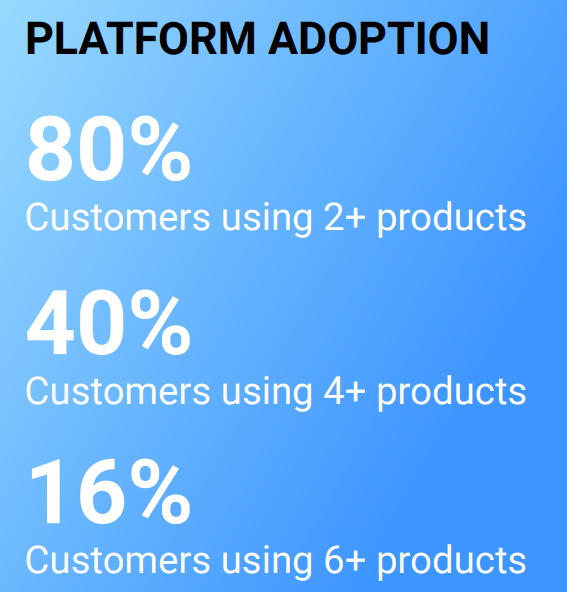

At the end of Q3 2022, 80% of the company's customers were using more than two products, 40% were using more than four products, and 16% were using more than six products. The growth in these figures indicates that Datadog has been successful in cross-selling, which is an important quality. We expect that further product launches by the company will contribute to the continued growth of these figures.

Source: Investor Presentation

Financial indicators

The company's results for the last 12 months:

TTM revenue: up from $880.1 million to $1531.9 million

TTM operating profit: up from -$36.5 million to -$15.6 million:

in terms of operating margins, increase from -4.1% to -1.0% due to a decrease in SG&A expenses from 40.2% to 36.7%

TTM net profit: up from $-44.1 million to $-14 million

in terms of net margin, up from -5% to -0.9%

Operating cash flow: increase from $194.6 million to $419.8 million mainly due to improvement in non-cash items

Free cash flow: up from $160.5 million to $363.9 million

Based on the results of the most recent reporting period:

Revenue: up from $270.5 million to $436.5 million

Operating profit: down from -$4.9 million to -$31.3 million:

in terms of operating margins, down from -1.8% to -7.2%, mainly due to an increase in SG&A expenses from 156.6% to 180.2% due to expansion of the sales force and infrastructure costs

Net income: down from $-5.5 million to $-26 million

in terms of net margin, down from -2% to -6%

Operating cash flow: up from $67.4 million to $83.6 million

Free cash flow: up from $57.1 million to $67.1 million

Datadog has delivered an excellent performance over the past 12 months, given the high base and negative market sentiment in 2022. In our view, the decline in profitability in Q3 is temporary and the increase in sales force costs will be recouped by a further increase in the number of products used by customers.

- Cash and liquid assets: $1.77 billion

- Net debt: -$1.03 billion

Negative net debt allows Datadog to feel confident during the transition from loss-making to profitable business, leaving room for investment in research and company growth.

Evaluation

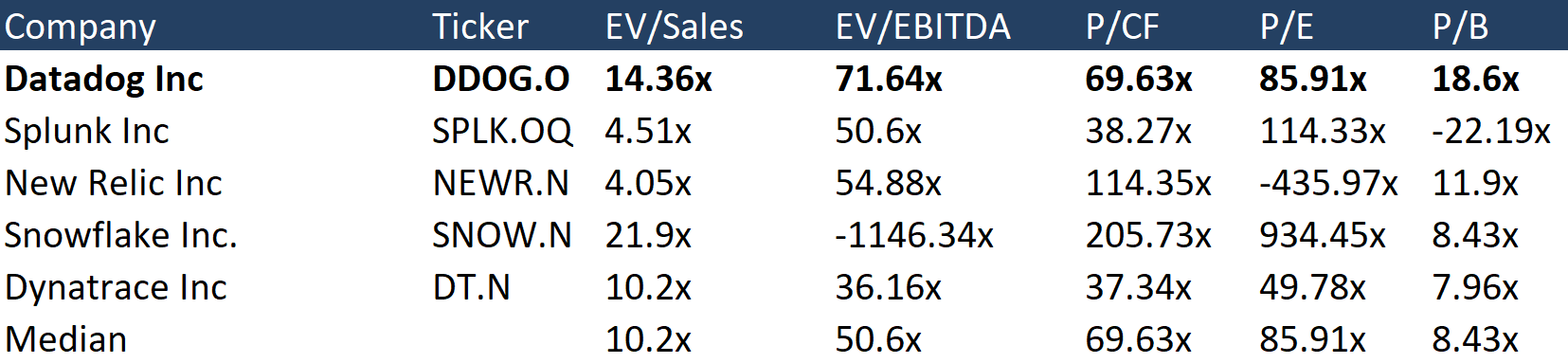

In terms of trading multiples, Datadog trades above its competitors except for EV/EBITDA and P/CF.

Source: Refinitiv

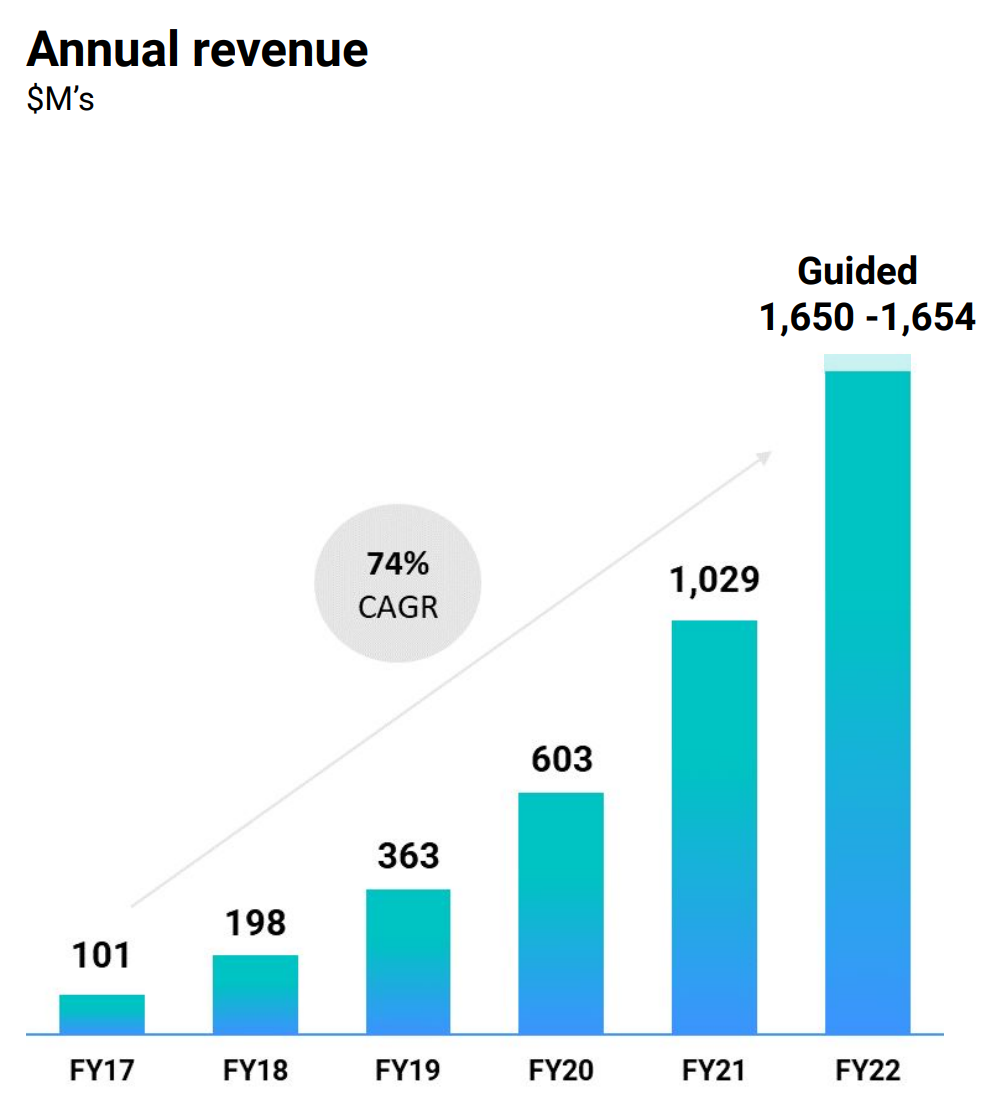

The company's expensive multiples are linked to its growth rate (as shown in the illustration below, the average annual revenue growth rate since 2017 is 74%) and significant growth potential due to good positioning relative to market trends.

Source: Investor Presentation

For the year, management expects revenues of $1.65 billion, non-GAAP operating income of $300-$304 million, and non-GAAP EPS in the range of $0.90-$0.92. In our view, the projections are quite realistic and already take into account the temporary margin squeeze that appeared earlier.

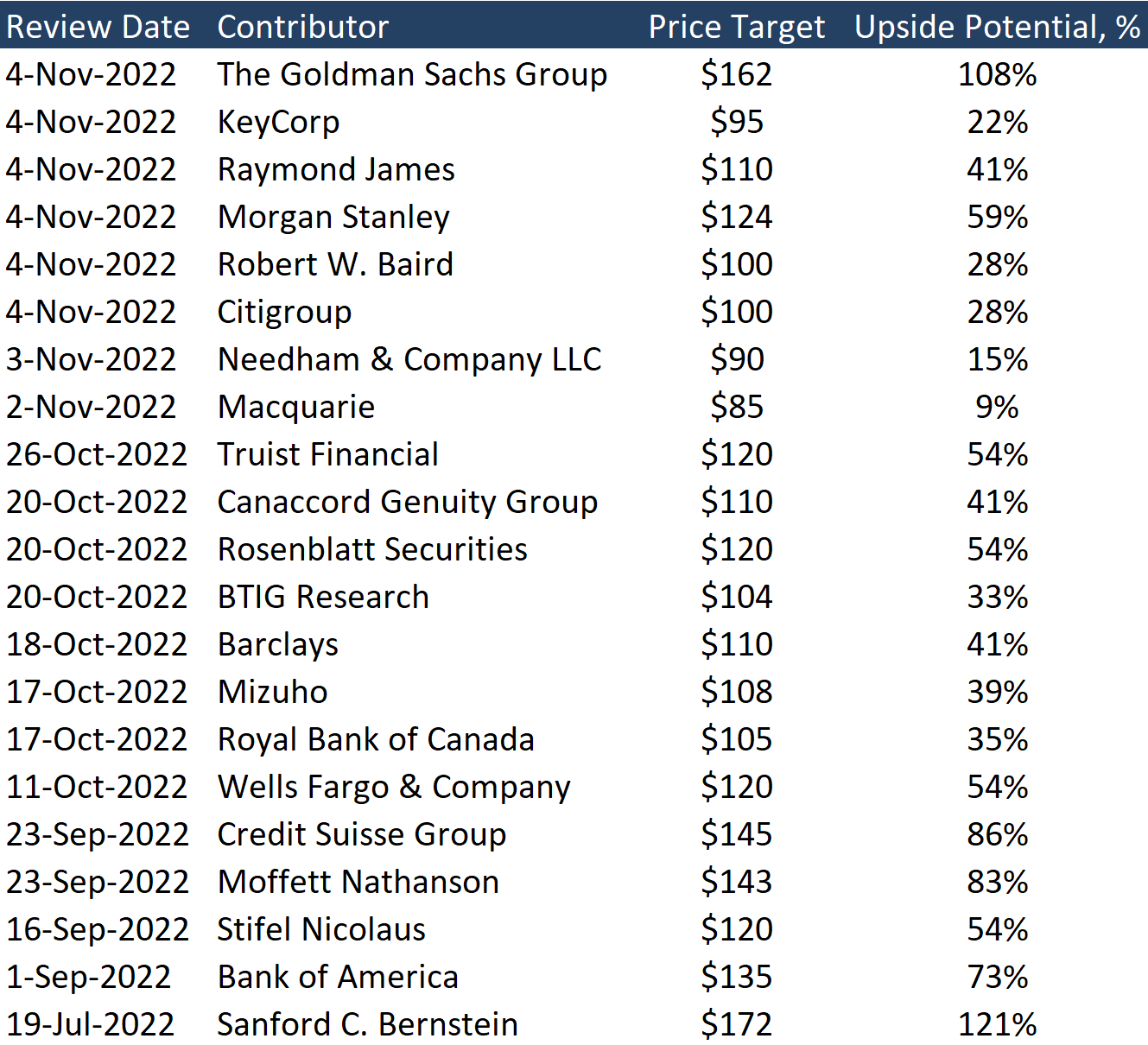

Ratings of other investment houses

The minimum price target set by Macquarie is $85 per share. Sanford C. Bernstein, in turn, set a target price of $172 per share. According to the consensus, the fair value of the stock is $118 per share, which implies a 51% upside potential.

Source: Marketbeat

Key risks

- Significant investment in R&D could weaken a company's financial stability in the event of a recession.

- Expensive valuation by multiples implies greater volatility in case of negative events (e.g. cybersecurity incidents).

- Against the backdrop of a potential recession, the company may lower its forecasts for next year, which could eventually lead to a significant sell-off in the company's stock.

Sources of information

- https://investors.datadoghq.com/static-files/986ca4cd-9507-4c9d-b56f-4bae59d3dd47

- https://investors.datadoghq.com/news-releases/news-release-details/datadog-acquires-cloudcraft-create-live-cloud-architecture

- https://investors.datadoghq.com/news-releases/news-release-details/datadog-launches-cloud-security-management-provide-cloud-native

- https://investors.datadoghq.com/news-releases/news-release-details/datadog-launches-unified-end-end-testing-platform

- https://investors.datadoghq.com/news-releases/news-release-details/datadog-introduces-cloud-cost-management

- https://investors.datadoghq.com/static-files/a57dd3e2-847b-4a16-b867-69d484a37628

- https://investors.datadoghq.com/static-files/cc06aec9-19a9-4c38-9356-c94ac10c7ba7

- https://investors.datadoghq.com/static-files/f45d1f6e-504e-4fbd-850a-6b9c730fdaf8

- https://www.marketbeat.com/stocks/NASDAQ/DDOG/price-target/

Disclaimer

Information and analytical services and materials are provided by Lion Capital Group as part of the services specified and are not an independent activity. The Company reserves the right to refuse service to persons not meeting the criteria for clients, or those subject to bans / restrictions on such services in accordance with the European Union laws. Restrictions may also be imposed by the internal procedures and controls of Lion Capital Group. Lion Capital Group provides financial services in the European Union in accordance with license CIF 275/15 for all types of activities required by the company as granted by the Cyprus Securities and Exchange Commission (CySEC) on 20.05.2015. Disclaimer: Additional information is available upon request. Investing in securities and other financial instruments always involves the risk of capital loss. The client must personally acknowledge this, including by reading the Risk Disclosure Notice. Opinions and estimates represent our judgments as of the date hereof and are subject to change without notice. Fees, charges and other expenses may reduce the financial performance of your investment. Past returns do not guarantee future returns. This material is not intended to be an offer or solicitation to buy or sell any financial instrument. The opinions and recommendations provided herein do not consider any individual circumstances, goals or needs of the client and do not constitute an investment advisory service. Recipients of this report must make their own independent decisions in relation to any securities or financial instruments referred to herein. The information has been obtained from sources that Lion Capital Group believes to be reliable; its affiliates and/or subsidiaries (jointly referred to as Lion Capital Group) do not guarantee completeness or accuracy of such information, save for disclosures related to Lion Capital Group and/or its affiliates/agents and analyst's interactions with the issuer being the subject of research. All prices provided are indicative closing prices for the securities in question, unless otherwise specified.

Terms and conditions of market research use

Company income statement

| 2023 | |

|---|---|

| Revenue | 1 028.78M |

| EBITDA | 25.57M |

| Net Income | -20.75M |

| Net Income Ratio | -2.02% |

Financial strength

| 2023 | |

|---|---|

| Debt/Eq | 128.66% |

| FCF Per Share | 0.81 |

| Interest Coverage | -0.91 |

| EPS | -0.07 |

| Payout ratio | 0.00% |

Management efficiency

| 2023 | |

|---|---|

| ROAA | -0.87% |

| ROAE | -1.99% |

| ROI | -1.03% |

| Asset turnover | 0.43 |

| Receivables turnover | 3.83 |

Margin

| 2023 | |

|---|---|

| Gross Profit Margin | 77.23% |

| Net Profit Margin | -2.02% |

| Operating Profit Margin | -1.86% |